|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

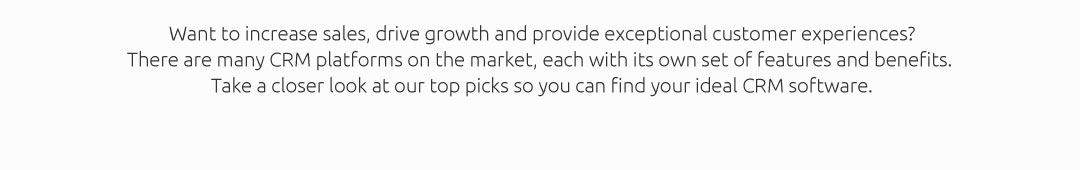

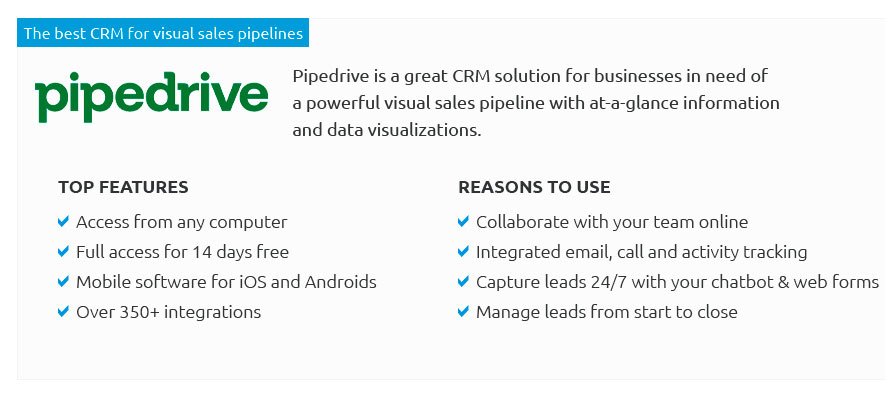

41f87uqzd CRM Mortgage: Insights, Benefits, and Essential ToolsUnderstanding CRM in the mortgage industry can revolutionize how lenders and borrowers interact. Customer Relationship Management (CRM) systems are designed to streamline processes, enhance customer experience, and ultimately drive business growth. What is CRM in the Mortgage Industry?A CRM mortgage system is tailored to meet the specific needs of mortgage professionals. It assists in managing client interactions, tracking leads, and automating various aspects of the mortgage process. This system empowers lenders to provide personalized service to clients, enhancing customer satisfaction and retention. Key Features of Mortgage CRM Systems

Benefits of Using CRM in MortgagesImplementing a CRM system in the mortgage industry offers several advantages:

For those seeking an best CRM for B2B sales, exploring different platforms can offer valuable insights. Challenges and ConsiderationsDespite its benefits, integrating a CRM system presents challenges. Data migration, user training, and system customization require careful planning and execution. Overcoming Common ChallengesTo effectively implement a CRM system, businesses should:

Additionally, using tools like an editable week calendar can complement CRM systems, helping to organize tasks efficiently. FAQ SectionWhat is the main purpose of a CRM system in the mortgage industry?The main purpose is to enhance customer relationships by streamlining processes, automating tasks, and providing personalized service, ultimately leading to increased customer satisfaction and business growth. How does a CRM system improve efficiency in mortgage lending?A CRM system improves efficiency by automating repetitive tasks, managing leads and customer interactions effectively, and providing insights through analytics, which helps in making data-driven decisions. Can CRM systems be customized for different mortgage businesses?Yes, CRM systems can be tailored to fit the specific needs of different mortgage businesses, ensuring they align with unique operational requirements and customer engagement strategies. https://bntouch.com/

Automate your marketing, convert more leads, and stay top of mind with your borrowers using the best mortgage CRM solution. https://loanofficercrm.ai/

The mortgage marketing CRM that comes pre-built with campaigns, proven to help you close more loans, powered by A.I., world-class dedicated support, ... https://mloflo.com/

Take a proven mortgage business building system and enable it with cutting edge technology and you get mloflo! The only mortgage crm on the ...

|